Preparing an IP portfolio for due diligence

1 June 2018

International Law Office (ILO) has published an article on IP Portfolio Management by Zacco’s Senior Partner Tom Ekeberg from the office in Oslo, Norway.

In the article, he shows “how to prepare for IP due diligence to ensure that a company can get the most out of its IP portfolio in a favourable deal. While the focus is on patents, the general principles apply to trademarks, industrial designs and even unregistered rights like copyright and trade secrets.

Why due diligence?

When an investor performs due diligence the intention is to obtain some kind of assessment of the value of the object he or she is about to invest in and determine risk. While risk is not necessarily bad and investors are not interested in eliminating risk, higher risk can be justified only by a higher expected return on investment or by some form of risk mitigation. Higher risk for an object with a certain expected return means lower price, and risk mitigation typically means a deal structure that is unfavourable to the seller or recipient of the investment (eg, in the form of payment being partly contingent on certain future events). Anything discovered during due diligence research that deviates from the presentations made by the seller and the buyer will be presented in the due diligence report as factors that will affect the expected return on investment or risk, and that may ultimately change the value and structure of the deal. […] ”

You can access the full article here on the ILO website.

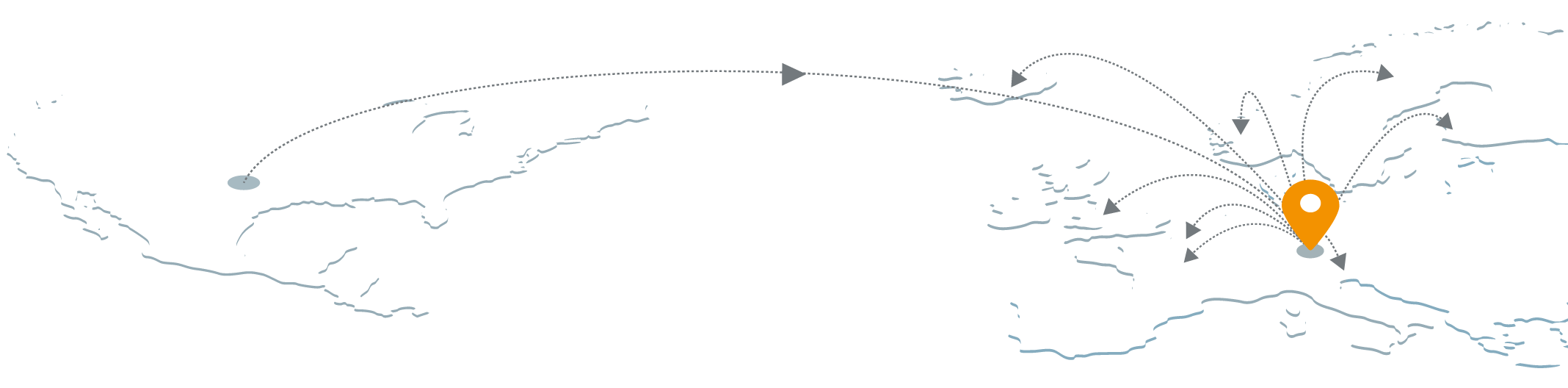

If you are looking for advice on how to manage your Intellectual Property porfolio, you are welcome to contact Senior Partner and Team Manager Tom Ekeberg directly or get in touch with a Zacco office close to you.

Back to all news